Nullam dignissim, ante scelerisque the is euismod fermentum odio sem semper the is erat, a feugiat leo urna eget eros. Duis Aenean a imperdiet risus.

Nullam dignissim, ante scelerisque the is euismod fermentum odio sem semper the is erat, a feugiat leo urna eget eros. Duis Aenean a imperdiet risus.

author

author

2026 Latin America’s Perfume Industry – Trends, Shifts, and Opportunities Introduction

The Latin American perfume market is entering a dynamic phase in 2026, driven by rising consumer purchasing power, growing online retail channels, and a shift toward premium and niche fragrances. Countries like Mexico, Colombia, Brazil, and Chile are not only increasing domestic consumption but also expanding export activities to Europe, the Middle East, and North America. For perfume brands and packaging suppliers, understanding the upcoming changes in product design, sustainability standards, and consumer preferences will be critical for market success.

1. Introduction: Latin America’s Perfume Market Enters a New Era

The Latin American perfume industry is evolving at a remarkable pace. With a unique blend of cultural heritage, rising middle-class spending, and increasing global brand exposure, the region is set to experience a wave of growth in both domestic and international fragrance consumption.

As we approach 2026, several factors are shaping the future: the rise of niche perfume brands, growing demand for sustainable packaging, and the blending of local scents with global luxury standards.

For perfume packaging suppliers-especially those specializing in premium perfume caps, perfume labels, and complete decorative solutions-this transformation brings both opportunities and competition.

2. Current Market Landscape in Latin America

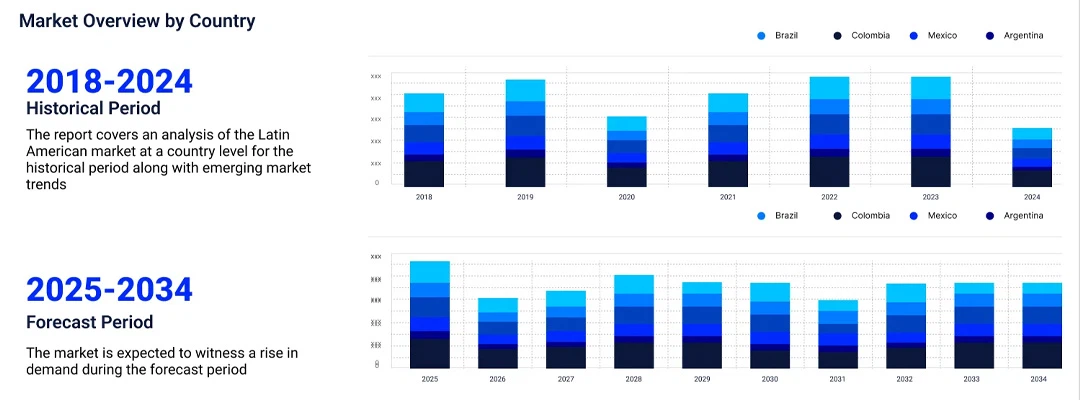

Latin America’s perfume industry is among the fastest-growing globally, with Brazil, Mexico, and Colombia leading in production and consumption. According to market estimates:

The market in 2025 is valued at over USD 12 billion, and is projected to grow steadily at a CAGR of 4–5% until 2028.

3. 2026 Key Trends Shaping the Latin American Perfume Industry

3.1 Premiumization and Affordable Luxury

Latin American consumers are increasingly willing to pay more for quality over quantity. This shift favors perfume brands that invest in high-end packaging-luxury glass bottles, Zamac caps, and intricate embossing-to convey exclusivity.

💡 Supplier Opportunity: Brands will need distinctive perfume caps that balance luxury feel and cost-efficiency. For example, Zamac caps with custom plating (gold, rose gold, matte black) are increasingly favored.

3.2 Rise of Niche and Artisanal Fragrances

Local scents inspired by Amazonian botanicals, Andean flowers, and tropical fruits are becoming signature elements in Latin American niche perfumes. These brands often seek smaller production runs but demand high-quality, customizable packaging to compete with global names.

💡 Supplier Opportunity: Offering low-MOQ yet premium packaging solutions-such as engraved aluminum caps, eco-friendly wooden caps, or biodegradable resin finishes-will appeal to these artisanal creators.

3.3 Sustainability Becomes Mainstream

Eco-conscious consumers are pushing brands to adopt sustainable materials and production practices. This includes:

💡 Supplier Opportunity: By developing caps using recycled Zamac alloys or certified wood, suppliers can position themselves as leaders in sustainable luxury.

3.4 Digital-First Marketing and Social Commerce

Platforms like Instagram, TikTok, and Facebook are now key drivers for perfume sales in Latin America. Influencer partnerships and user-generated content are influencing buying decisions more than traditional advertising.

💡 Supplier Opportunity: Brands increasingly request creative perfume packaging that stands out in online content-meaning high-contrast textures, reflective finishes, and bold shapes for perfume caps.

4. Market Challenges and How Brands Can Adapt

4.1 Currency Fluctuations and Import Costs

Volatile currencies in Latin America can impact import prices for luxury packaging components.

Solution: Suppliers should offer local warehousing or partial in-region production to reduce freight and customs costs.

4.2 Counterfeit Products

The rise in counterfeit perfumes erodes brand value.

Solution: Integrating anti-counterfeit technology into packaging, such as laser-engraved serial codes on perfume caps, can help protect authenticity.

4.3 Diverse Consumer Preferences

Perfume taste varies widely between countries. For example:

Solution: Packaging designs should reflect cultural nuances while maintaining brand consistency.

5. Forecast: 2026 and Beyond

By 2026, the Latin American perfume market will be more premium, personalized, and sustainable than ever before. We expect:

Increased collaboration between local niche brands and international suppliers.

A surge in eco-friendly packaging demand.

Higher adoption of customized perfume caps as a branding tool.

Brands that can merge Latin American cultural identity with world-class packaging design will win consumer loyalty.

6. How Our Perfume Cap Solutions Fit the 2026 Trends

At Leaders Factory, we specialize in high-quality perfume caps that meet the evolving needs of the Latin American market:

Our designs are not just functional-they tell your brand story through touch, weight, and visual presence.

7. Time to Upgrade Your Product Plans

The Latin American perfume market in 2026 will be vibrant, competitive, and innovation-driven. Packaging-especially perfume caps-will play a decisive role in influencing purchasing decisions, whether for mass-market or niche brands.

For B2B buyers, the next two years present the perfect window to upgrade packaging strategies, ensuring products align with premiumization, sustainability, and cultural relevance.

With the right partner, your brand can not only adapt to these shifts but lead the market transformation.

Contact us to get free packaging concept consultation & samples for your market!

Leave a comments